The Million-Dollar Questions You Need To Ask To Know If You’re Ready For Retirement

There is no universally accepted formula or rule for determining how much money it will take for you comfortably retire. $1 million is a somewhat arbitrary figure that has long seemed like a reasonable finish line; a study by Nerdwallet found that half of Americans still view $1 million as their target.

But MarketWatch research has found that the $1 million guideline is outdated based on most people’s retirement goals, due to rising medical costs and overall increases in the cost of living.

Finding a more suitable savings target is where retirement planning strategies, available in the Bucks County, PA area from Secure Retirement Strategies, can help. The key to retirement is selecting and stick to a saving strategy, but how much do you need to save? One commonly used formula comes to us courtesy of Fidelity, and takes into account key factors like age and starting salary:

- By age 40, your savings should be triple your starting salary

- By age 50, your savings should be six times your starting salary

- By age 67, your savings should be ten times your starting salary

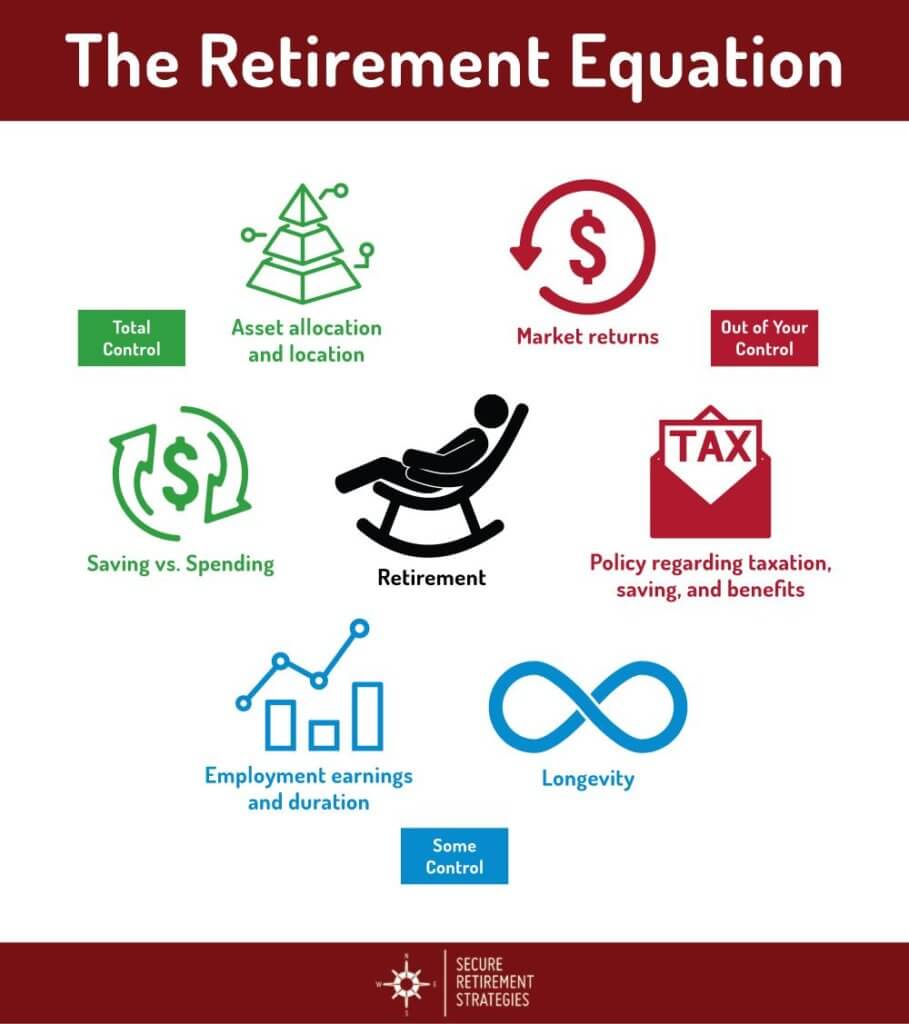

Of course, everyone’s circumstances will vary, and everyone’s retirement strategy, including retirement age, will be different as a result. The location and allocation of your assets and how much you’re saving vs. how much you’re spending are factors you can control; whereas market returns and your health and longevity are more unpredictable.

Here’s a quick infographic to depict a few factors that play into your control of the Retirement Equation:

How to Retire at 50 – Or Even Earlier

There is a growing disparity between Americans in terms of how committed they are to retirement planning. Data from the National Institute on Retirement Security shows that almost three out of every five working-age people have none of the following:

- Employee-sponsored 401(k) or similar plan

- An IRA

- A defined-benefit plan

Meanwhile, those who are preparing for retirement are increasingly putting their planning into overdrive in hopes of early retirement.

The full retirement age for social security for people born between 1943 and 1954 is 66, but some people are following strategies that will allow them to retire at much younger ages. These people are forming the Financial Independence, Retirement Early (FIRE) movement, which is gaining in popularity:

- A couple is saving 70% of their income and is spending only $44,000 a year, a whopping decrease from their previous annual spending of $110,000

- A woman whose target retirement age is 38 saving money wherever she can: driving a 15-year-old car and heating her home with a fireplace

While not everyone is ready for such radical lifestyle changes, the time to start saving is now. By setting your retirement goals (such as age and location) and following a strategy that will make these goals realistic, retirement is within your reach.

People in the Hunterdon County, NJ area can get retirement income planning help from Secure Retirement Strategies. Contact us today!