Retirement Planning for a Worry-Free Future

Professional Legacy Planning from Secure Retirement Strategies

What Is Legacy Planning?

While most people are somewhat familiar with the term estate planning, many don’t fully understand what legacy planning is and how it differs from estate planning. When planning a legacy, we take a more holistic approach than what is typically used for estate planning. We help our clients create a definitive plan for managing their overall wealth while they are alive and distributing their estate how they see fit after their death. We work to ensure that you have a clear plan to pass on your legacy to the ones who matter the most.

With so many investment products on the market, it can be hard to figure out which one will meet your needs. To help you understand how an annuity can fit your long-term goals, we’ve compiled a list of the three major reasons why investors buy annuities.

What Are Estate and Inheritance Taxes, and How Do They Affect My Legacy?

One of the biggest things people do not consider is protecting their estate from potential threats like legal issues, creditors, and the ever-dreaded taxes. Put simply, an estate tax is a tax that is levied when an heir inherits a portion of an estate that is valued at an amount that exceeds the exclusion limit set by law. In contrast, inheritance tax is an additional tax often applied to an estate from the first dollar left to heirs.

What this means is if your estate’s value exceeds the limit set by the IRS, your heir will be required to pay federal taxes on the assets of your estate. If they live in a state that still enforces inheritance taxes, they will also have to pay state taxes on any assets they have inherited from you. Pennsylvania and New Jersey both can apply inheritance taxes depending on who the beneficiary is.

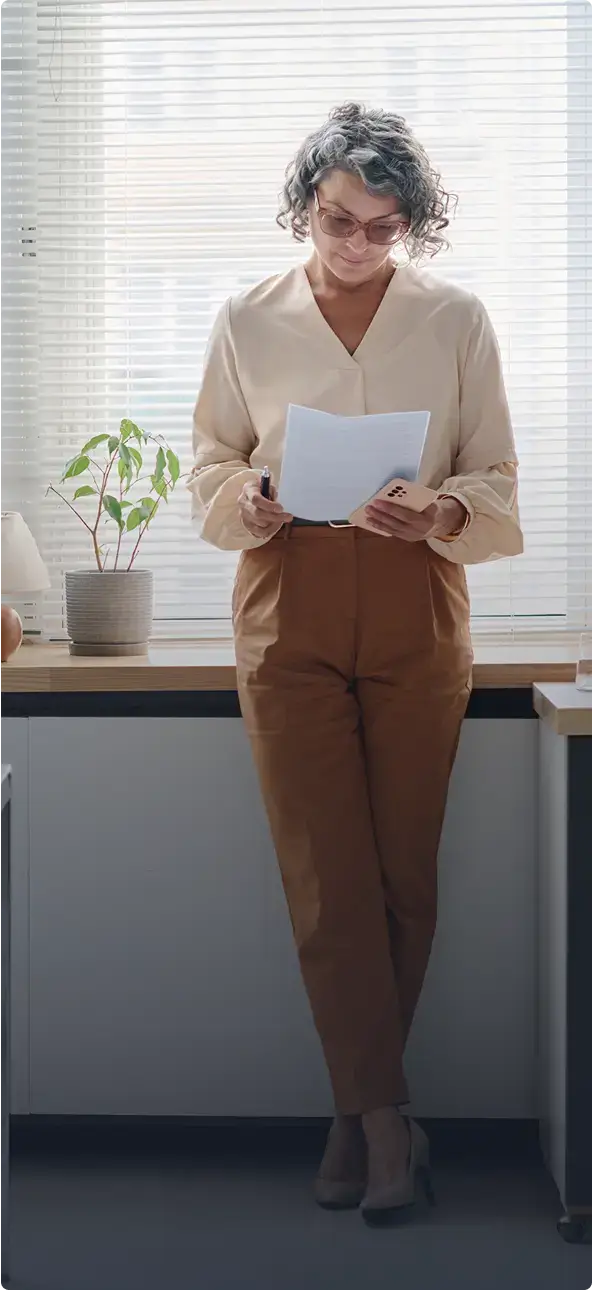

How Can Secure Retirement Strategies Help Me Plan for the Future?

If you’ve already begun to think about your financial legacy, you’ve probably asked yourself who should receive my financial legacy, what should I leave behind, and when should my assets be passed down? These types of questions are common, and our team of professional advisors has the answers you’ve been searching for.

Our financial legacy planning strategies utilize retirement tools such as:

Indexed Universal Life Insurance

Tax-Free Income Investments

Life Insurance Retirement Plan

Annuity Accounts

Want More?

Answering Your Biggest Questions to Build Your Financial Future Across Pennsylvania and New Jersey

Legacy planning is about creating lasting financial security for you and your loved ones. Our team works with families across Lehigh, Bucks, Chester, Northampton, Mercer, and Hunterdon Counties to develop comprehensive financial planning solutions that protect your retirement savings and create enduring legacies.

The complexities of legacy planning involve numerous moving parts, including tax considerations and asset protection strategies. If this sounds overwhelming, don't worry. We're here to guide you through every step and answer your crucial questions about securing your family's financial future.