Comparing the LIRP With a Roth IRA

Retirement planning can come in all different shapes and forms, including a variety of different accounts. With each account serving a different purpose, it might be a bit confusing deciding what to invest in. Luckily, Secure Retirement Strategies can be your resource for retirement income planning in Hunterdon County, Mercer County, Middlesex County, Somerset County, Burlington County, and Camden County in New Jersey, and Bucks County, Montgomery County, Lehigh County and Northampton County in PA.

Retirement planning can come in all different shapes and forms, including a variety of different accounts. With each account serving a different purpose, it might be a bit confusing deciding what to invest in. Luckily, Secure Retirement Strategies can be your resource for retirement income planning in Hunterdon County, Mercer County, Middlesex County, Somerset County, Burlington County, and Camden County in New Jersey, and Bucks County, Montgomery County, Lehigh County and Northampton County in PA.

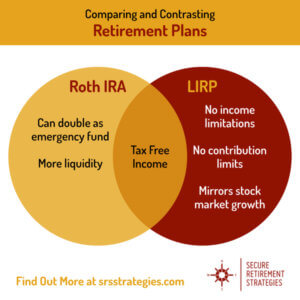

Two of the accounts we believe are especially helpful to those looking to plan for retirement are Roth IRAs and Life Insurance Retirement Plans. They might seem like similar accounts, but they have their differences that make both of them valuable assets while saving.

When you put money into a LIRP account, you are getting an account with no limits on income or contribution. For this reason, many refer to it as the “rich man’s Roth.” Both accounts have tax-free income benefits, which is one of the biggest reasons why people invest in them. Roth IRAs, however, have many of the limitations that LIRPs are known for not having. LIRPs are also frequently heralded for being a secure account that mirrors stock market growth, except without the risk of losing your savings.

Roth IRAs, on the other hand, allow your money to grow tax-free, while also giving you a deduction on the front end and lets you withdraw your money tax-free. In some cases, a Roth IRA may be set up through your employer, who will match you and help you pay back the tax on the back end. Many consider opening a Roth IRA to be a necessity of retirement planning because of all the benefits that they offer.

When it comes down to it, both are accounts that are necessary to have. As we mentioned earlier, different accounts function in different ways, and they each have their own benefits and limitations. When you have both, they complement each other so that when one account can’t give you a particular benefit, the other can.

When it comes down to it, the LIRP is essentially a supercharged version of a Roth IRA. The LIRP is an incredible account that bolsters your retirement savings in ways many accounts can’t do, including:

- Risk-free index investing

- Tax-free long-term care

- A tax-free death benefit

- And protection from creditors and predators

If you are planning on opening up a LIRP, you are getting great benefits – in many cases, better than accounts such as Roth IRAs. If you are looking to open up your LIRP account, set up an appointment with Secure Retirement Strategies, and see the benefits of a tax-free life insurance plan for yourself. For more information on how to enroll, contact us today!