Handling a Decline in Your 401(k) Value: Strategies for Recovery

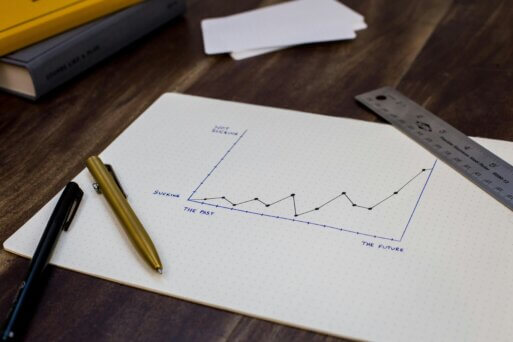

Investing in a 401(k) is a strategy many adopt with the hope of growing their savings over time. However, fluctuations in the market mean that the value of these investments doesn’t always increase. Seeing your 401(k) balance drop can be disheartening and might prompt a knee-jerk reaction to liquidate your